WV DoR CST-200CU 2018-2024 free printable template

Show details

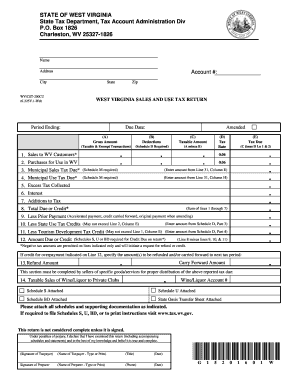

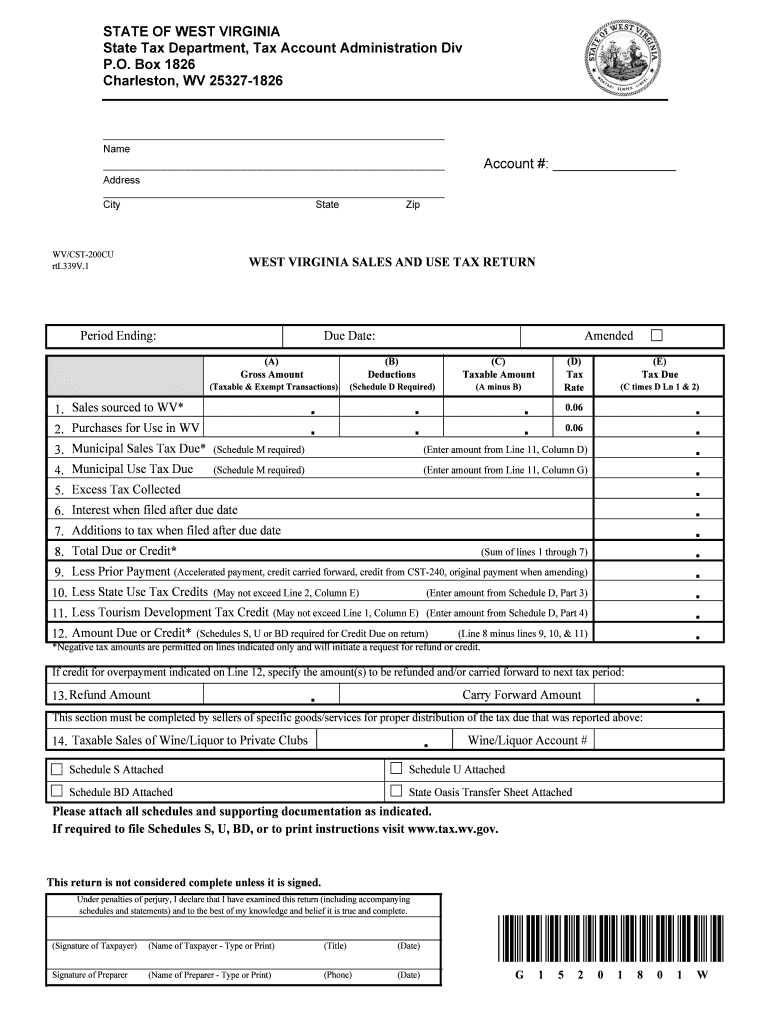

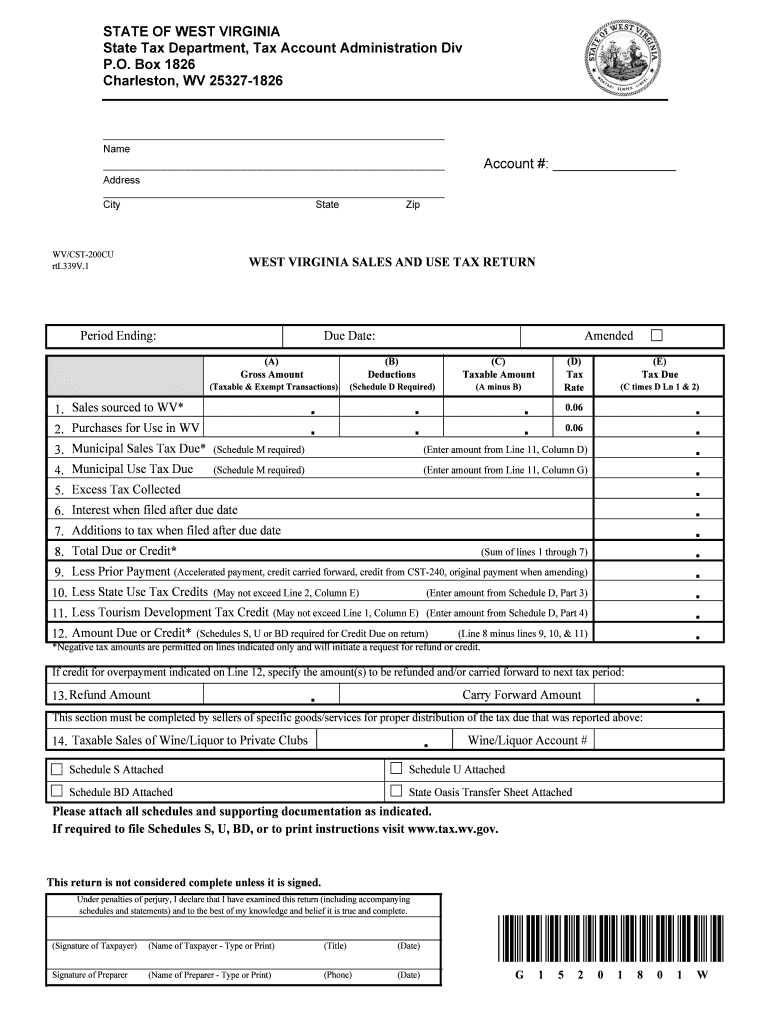

STATE OF WEST VIRGINIA State Tax Department Tax Account Administration Div P. O. Box 1826 Charleston WV 25327-1826 FINAL COAT PAINTING INC Name 3185 TERMINAL DR SAINT PAUL MN 55121-1629 Address City State Zip WV/CST-200CU rtL339V. Sales sourced to WV 2. Purchases for Use in WV 3. Municipal Sales Tax Due 4. Municipal Use Tax Due E Tax Due C times D Ln 1 2 Enter amount from Line 11 Column D 5. Excess Tax Collected 6. Interest when filed after due date 7. Additions to tax when filed after due...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your wv cst 200cu 2018-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wv cst 200cu 2018-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing wv cst 200cu online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit wv sales and use tax form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

WV DoR CST-200CU Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out wv cst 200cu 2018-2024

How to fill out WV sales and use:

01

Gather all necessary information and documentation related to your sales and use tax liabilities in West Virginia.

02

Fill in the required information on the designated sections of the WV sales and use tax form, such as your business name, address, and tax account number.

03

Calculate your gross sales during the reporting period and enter the appropriate figures in the designated section of the form.

04

Determine the applicable sales and use tax rates for your taxable sales and enter the amounts in the appropriate columns.

05

Include any exemptions or deductions that may apply to your sales and use tax liabilities. Make sure to provide the necessary supporting documentation if required.

06

Calculate the total sales and use tax liability by adding up the figures from all relevant sections.

07

Double-check all the information provided on the form for accuracy and completeness.

08

Sign and date the form, and submit it by mail or electronically, as instructed by the West Virginia State Tax Department.

Who needs WV sales and use:

01

Businesses operating in West Virginia that make sales of taxable goods or services are generally required to file and pay sales and use tax.

02

Retailers, wholesalers, manufacturers, and service providers are among the types of businesses that may need to report and remit sales and use tax in WV.

03

Both in-state and out-of-state businesses may have obligations to comply with WV sales and use tax regulations if they meet the criteria established by the state.

Fill wv sales and use tax return form : Try Risk Free

People Also Ask about wv cst 200cu

What is the sales and use tax rate in WV?

What is the WV sales and use tax return form?

How do I register for sales and use tax in West Virginia?

How do you calculate sales tax in WV?

What is Schedule D for sales and use tax in WV?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is wv sales and use?

WV Sales and Use is the West Virginia Sales and Use Tax. This tax applies to the sale of goods and services in West Virginia, and is collected by the West Virginia State Tax Department. The tax rate is 6% of the sales price.

Who is required to file wv sales and use?

Any business that makes retail sales, rents or leases tangible personal property, or provides taxable services in West Virginia must register with the West Virginia State Tax Department and collect and remit West Virginia sales and use tax.

How to fill out wv sales and use?

1. Gather the necessary information:

- Your business’s Federal Employer Identification Number (FEIN)

- The seller’s name, address, and Federal Employer Identification Number (FEIN)

- The county where the sale occurred

- The date of sale

- The type of sale (retail, wholesale, or resale)

- The type of product or service sold

- The total amount of the sale (taxable, exempt, or both)

2. Obtain the West Virginia Sales and Use Tax Form (Form C-20) from the West Virginia State Tax Department.

3. Fill out the form:

- Enter the information for the seller and purchaser at the top of the form

- Enter the county of sale in the appropriate box

- Enter the date of sale in the appropriate box

- Enter the type of sale in the appropriate box

- Enter the type of product or service sold in the appropriate box

- Enter the total amount of the sale (taxable, exempt, or both) in the appropriate boxes

4. Calculate the sales and use tax:

- Enter the total amount of the sale in the appropriate box

- Calculate the sales and use tax by multiplying the taxable amount of the sale by the county sales tax rate (available from the West Virginia State Tax Department)

5. Submit the form:

- Sign and date the form

- Submit the form and payment to the West Virginia State Tax Department

What is the purpose of wv sales and use?

The purpose of West Virginia Sales and Use Tax is to ensure that West Virginia businesses collect and remit the appropriate taxes on sales and purchases made within the state. This helps the state generate revenue for infrastructure, public safety, and other important services.

What information must be reported on wv sales and use?

The West Virginia State Tax Department requires businesses to report and pay sales and use taxes on the sale of taxable goods and services. Sales and use taxes must be reported on the West Virginia Sales and Use Tax Return. Businesses must report the total amount of all taxable sales, the total amount of all taxable purchases, and the applicable sales and use tax collected or paid. Businesses must also report any applicable local sales and use taxes.

Businesses must also file a West Virginia Sales and Use Tax Annual Reconciliation Return, which summarizes the sales and use tax remitted during the prior calendar year. This return must include a summary of the total sales and purchases for the year, the amount of tax owed, the amount paid, the amount of refund due, and any other information required by the West Virginia State Tax Department.

When is the deadline to file wv sales and use in 2023?

The deadline to file West Virginia Sales and Use Tax returns for the 2023 tax year is April 30, 2023.

What is the penalty for the late filing of wv sales and use?

The penalty for late filing of West Virginia sales and use tax returns is 5% of the amount of tax due, plus interest at the rate of 1.5% per month or fraction of a month, up to a maximum of 25%.

How can I modify wv cst 200cu without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your wv sales and use tax form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I execute wv sales and use tax online?

pdfFiller makes it easy to finish and sign wv sales tax form online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I complete wv state use tax on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your wv sales and use tax return form. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Fill out your wv cst 200cu 2018-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wv Sales And Use Tax is not the form you're looking for?Search for another form here.

Keywords relevant to west virginia sales use tax return form

Related to west virginia sales tax return

If you believe that this page should be taken down, please follow our DMCA take down process

here

.